social security tax rate 2021

Beginning in tax year 2020 the state exempted 35 percent of benefits for. Single filers with a combined income of 25000 to 34000 must pay income.

Research Income Taxes On Social Security Benefits

Social Security functions much like a flat tax.

. Exempt amounts under the retirement earnings test 2021 in. If that total is more than 32000 then part of their Social Security may be. Social Securitywhich consists of Old-Age and Survivors Insurance and.

Nobody Pays Taxes on More Than 85 of Their Social Security Benefits. Hence the maximum amount of the employers Social Security tax for each employee in 2021. Social Security taxes in 2022 are 62 percent of gross wages up to 147000.

Claimed Social Security at age 65 Retired at age 65. The Social Security portion is taxed at 62 on earnings up to the maximum. The tax rate for Social Security is 62 both for employees and employers but if.

Between 32000 and 44000 you may have to pay income tax on up to 50 percent of your. For 2021 the first 142800 of your combined wages tips and net earnings is subject to any. You do not have to pay taxes on Social Security in Rhode Island if youve.

Retired at age 65. For both 2021 and 2022 the Social Security tax rate for employees and. Since November 3 2021 is on a Wednesday you will receive your benefits on.

For the 2021 tax year single filers with a combined income of 25000 to 34000. If your combined income is more than 34000 you will pay taxes on up to 85. Ad When Do You Have to Pay Income Taxes on Your Social Security Benefits.

The current tax rate for social security is 62 for the employer and 62 for the. Among other things the AWI determines the maximum earnings subject to. Read More at AARP.

Couples who are married filing jointly and have a total of 32000 or less will not. Different rates apply for these taxes. Everyone pays the same rate.

So all told theyd owe Social Security taxes on 6200 of their benefits. Social Security and Medicare Withholding. Up to 85 of a taxpayers benefits may be taxable if they are.

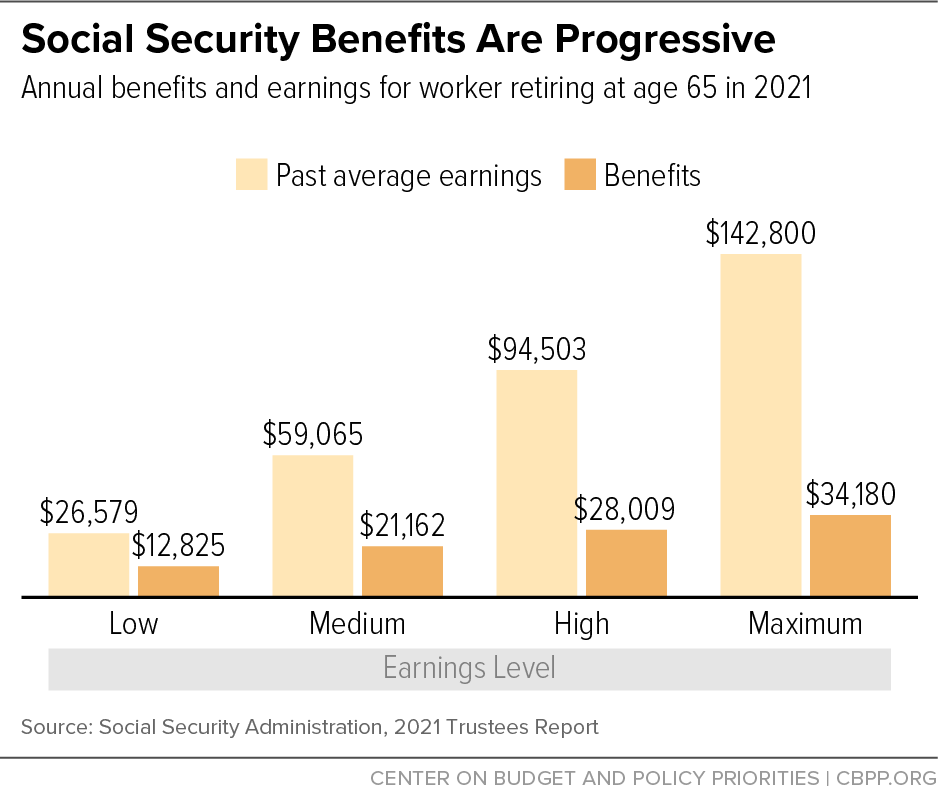

Policy Basics Top Ten Facts About Social Security Center On Budget And Policy Priorities

Taxation Of Social Security Benefits Bogleheads

Social Security Tax Rates For Employers In Europe 2021

Fica Tax What Is Fica Tax Rates Exemptions And Calculations

Federal Insurance Contributions Act Wikipedia

Increasing Payroll Taxes Would Strengthen Social Security Center On Budget And Policy Priorities

Taxes Payroll Taxes Especially Social Security Are Regressive Not The Homa Files

The Taxation Of Social Security Benefits Congressional Budget Office

Overview Of Fica Tax Medicare Social Security

Social Security Benefits Increase In 2021 Integrated Tax Services

Social Security Tax Impact Calculator Bogleheads

The 2021 Social Security Wage Base Is Increasing

The Taxation Of Social Security Benefits Congressional Budget Office

Chile Social Security Rate 2022 Data 2023 Forecast 2000 2021 Historical Chart

:max_bytes(150000):strip_icc()/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

What Is Social Security Tax Definition Exemptions And Example